You’ve decided it’s time to say goodbye to your Flipkart Pay Later account. Closing this account is not as complex as it may seem, but there are a few crucial things to keep in mind.

I’m here to guide you through the process step by step. Let’s see them,

Easy Way to Close Flipkart Pay Later Account

To permanently close your Flipkart Pay Later account, you need to get in touch with Flipkart Customer Support. Keep in mind that lender IDFC First Bank won’t be able to assist you directly in this matter.

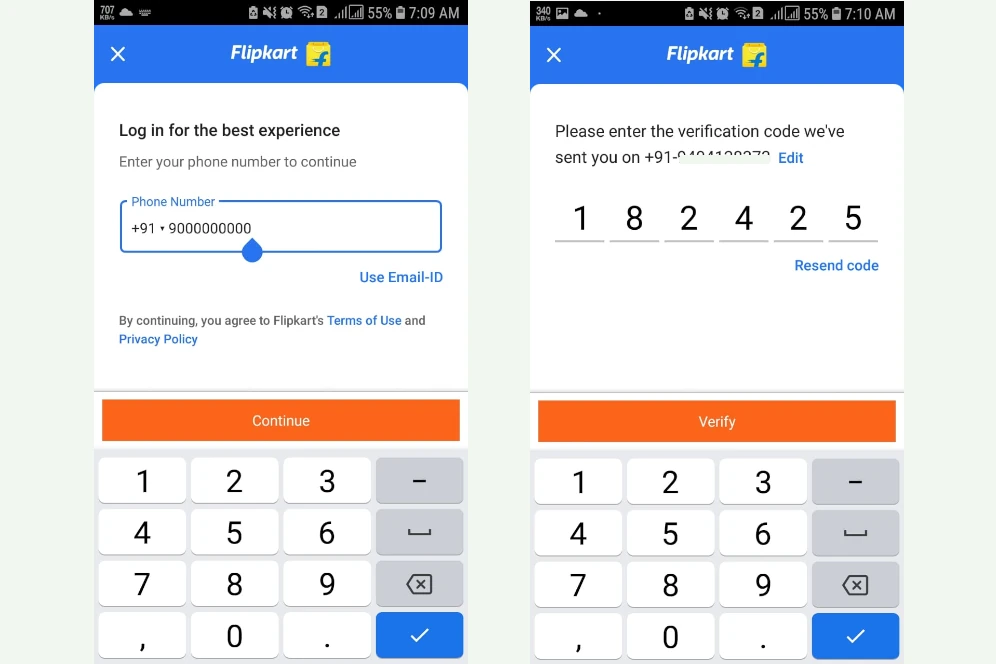

- Sign in and go to the Flipkart Help Center

- Select ‘I want help with other issues.’

- Choose ‘Others’ > ‘Other.’

- At this point, you’ll have the option to either ‘Chat’ or ‘Request for a Callback.’

Continue chatting with support or you will receive a call from a Flipkart customer representative within a few minutes upon callback request. Ask them to help you close your Flipkart pay later IDFC bank account.

Make sure to specify that you want your account to be permanently closed, not just temporarily paused or marked as inactive.

Call Customer Care to Close Flipkart Pay Later Account

You can contact Flipkart’s customer care executive at 04445614700 this number. Dial this number and select your language. Then dial the correct option number to talk to the executive option over call.

After the call is connected, talk to the executive and tell them that you have settled all due pay later amount and want to close it permanently.

Contact RBI Ombudsman (If Needed)

If, for any reason, your request for account closure isn’t honored, or if you don’t receive a No Objection Certificate (NOC) after requesting it, you have the option to escalate the matter. You can reach out to the RBI Ombudsman for grievance redressal. They are there to ensure your concerns are addressed.

Here is the official link: Reserve Bank of India – Complaints (rbi.org.in)

Thanks to Remember

Before you proceed with the account closure, there are a few things to remember:

- Make sure all your pending dues are cleared. Your account won’t be closed if there are outstanding payments.

- You should receive an NOC from your lending provider stating that your Flipkart Pay Later account is closed with no dues left. If you don’t receive it within 2-3 weeks of requesting account closure, follow up.

- Closing your account might lead to a temporary decrease in your credit score. Don’t be alarmed; it’s a normal part of the process.

- It may take 2-3 months for the ‘closure’ to reflect on your CIBIL profile. So, don’t be surprised if you see your Flipkart Pay Later loan as ‘active’ during this period.

- Even after your Flipkart Pay Later is closed, it will continue to appear on your CIBIL report as a ‘closed’ account for record-keeping purposes. Lenders like to see your credit history.

- If you haven’t used any credit cards before and were offered Flipkart Pay Later, consider keeping it active. The age of a credit line has a significant impact on your credit score. This could help you when you apply for a credit card or loan in the future.

As a responsible borrower, it’s wise to periodically check your Credit Information Bureau India Limited (CIBIL) report. It’s like your financial report card, and it’s always a good idea to be aware of your credit status. You can inspect your CIBIL report to ensure that your Flipkart Pay Later account is accurately represented. This gives you an overall view of your creditworthiness.

Go ahead and start the process to close your Flipkart Pay Later account if it’s the right decision for you. Your financial future awaits, and I’m here to help if you have any more questions or need guidance on other financial matters.

Feel free to engage and share your thoughts or questions. Your financial well-being matters! ????????